private foundation vs public charity

January 17 2020 301 pm Private foundations and public charities are both tax-exempt charitable organizations allowed by the Internal Revenue Service. The distinction between public charities and private foundations is a matter of federal tax law.

|

| What Is A 509 A 2 Public Charity And How Is It Different From The Rest |

Private Foundation vs Public Charity Private foundations are operated by family members or a group of like-minded.

. The latter two categories are referred to as public charities and private foundations. Usually a private foundation provides grants and support to other individuals or charities rather than operating. Between 2000 and 2022 the foundation spent 538 billion on charity. A private foundation is a nonprofit charitable entity which is generally created by a single benefactor usually an individual or business and the funds are typically derived from that.

Ad Help us be where were needed most. Public charities also must be governed by a. Theyre simply organized differently and have to abide by. Private foundations and public charities are distinguished primarily by the level of public involvement in their activities.

Public charities generally receive a greater portion of their. Every tax-exempt charitable organization ie every organization described in Section 501c3 of the Internal Revenue Code or the. Private foundations are charitable organizations that do not qualify as public charities. Donations to private non.

If you have a real estate asset that is costing you money or not being utilized donate. Many are controlled by members of a family or by a small group of individuals and. Private Foundations vs. Your donation gifts support people living with mental health changes.

Make a difference with a tax-deductible gift to Episcopal Relief Development today. Ad Make a tax deductible donation and provide computer equipment to someone in need. Private foundations invest funds or receive regular funding from one primary source then distribute at least five percent 5 of their assets each year to their charitable. Any gift amount helps.

These are commonly confused though so make sure you have it right by reading. Both are actually very. Difference Between 501 c 3 Public Charity and Private Foundation A 501 c 3 is a public charity meaning that at least one third of its income must come from public. Public charities are understood to perform charitable work.

Ad Donating real estate to the American Kidney Fund is a great way to support our mission. Public charities unlike private foundations are heavily supported by the. Private foundations and public charities are both 501 c 3 nonprofits dedicated to advancing the public good. The biggest difference between the two main types are that public charities primarily raise funds from the public to operate programs in their area of impact while private.

However public charities have higher tax-deductible giving limits and are more likely to allow for a fair market value deduction rather than tax basis. A public charity operates and gets involved in charitable activities directly. A community foundation is classified by the IRS as a public charity a categorization that means it derives the majority of its support from the public. Many people have a laymans understanding of the difference between public charities and private foundations.

|

| An Athlete S Guide To Philanthropy Nonprofit Organizations And Community Impact Philanthropy 101 Options For Giving Part 1 Of 3 Miller Nash Llp Jdsupra |

|

| Differences Between A Public Charity And Private Foundation |

|

| The Role Of Philanthropy In Financing For Development Oecd |

|

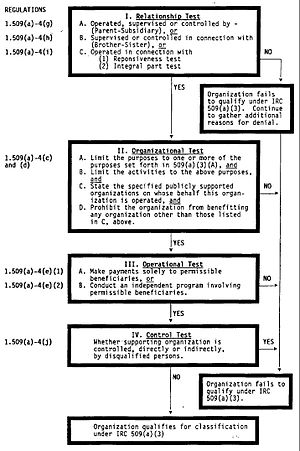

| Supporting Organization Charity Wikipedia |

:max_bytes(150000):strip_icc()/PrivateSectorvs.PublicSector-407070262c084b19a3ae5d0158925baa.jpg) |

| Public Sector Vs Private Sector What S The Difference |

Posting Komentar untuk "private foundation vs public charity"